Overview

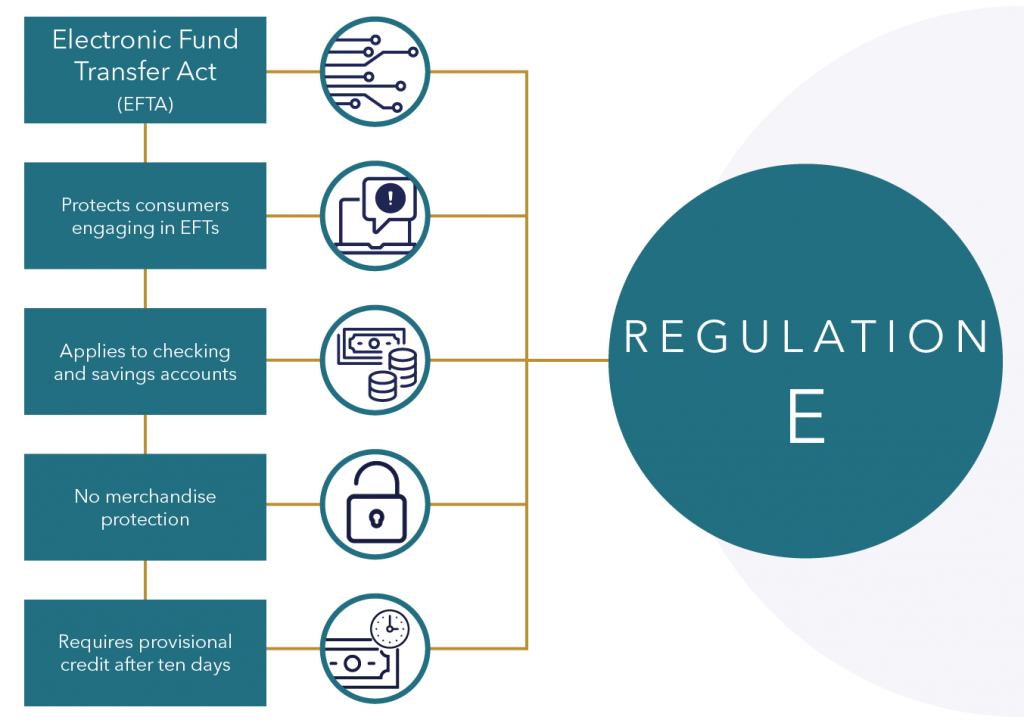

The Electronic Fund Transfer Act (EFTA), better known as Regulation E or “Reg” E, was established in 1978 to protect individual consumers engaging in electronic fund transfers (EFTs). The Federal Deposit Insurance Corporation (FDIC) defines EFTs as any transfer of funds, other than a transaction originated by check, draft, or similar paper instrument, which is initiated through an electronic terminal, telephonic instrument, or computer or magnetic tape to order, instruct, or authorize a financial institution to debit or credit an account.

Types of Transactions

Regulation E outlines rules for electronic funds transfers and provides guidelines for issuers and sellers of debit cards but not restricted to issuing banks, credit unions, and cardholders processing debit transactions. FinTechs, card processors, ACH (Automated Clearing House) wire transactions, and earned wage access services fall under EFT categorization within Reg E.

Requirements & Deadlines

The regulation dictates that account holders have 60 days to initiate a claim. Afterward, the issuer has ten days to investigate and resolve a claim.

Misconceptions

When it comes to streamlining the dispute management process, there are several regulatory misconceptions that stand in the way. Therefore, it is crucial to address what practices should be implemented or made obsolete.

FIs fall out of compliance by assuming that the act of providing provisional credit qualifies as having taken the first action in investigating a Reg E claim, which is required to extend the resolution period from 10 to 45 days. This widely held misinterpretation of Regulation E is legally incorrect, having systematically caused regulatory fines and penalties for issuers.

Penalties

Noncompliance with this law results in a $1,000 fine per violation, not to exceed 1% of the FI’s assets.

Regulation E vs. Regulation Z

Regulation Z disputes cover all credit or lending disputes. Unlike Regulation E, Reg Z does not require financial institutions to provide provisional credit after 10 days of being asked to investigate fraud. However, when Reg Z is in question, financial institutions must stop charging interest on the disputed amounts of their account holders.

Summary

» Think of Regulation E as applying to financial transactions with money that consumers really had. Reg E does not apply when transactions involve borrowed funds.

» Investigations must be completed within the first 10 days of a Reg E dispute in order for issuers to remain compliant.