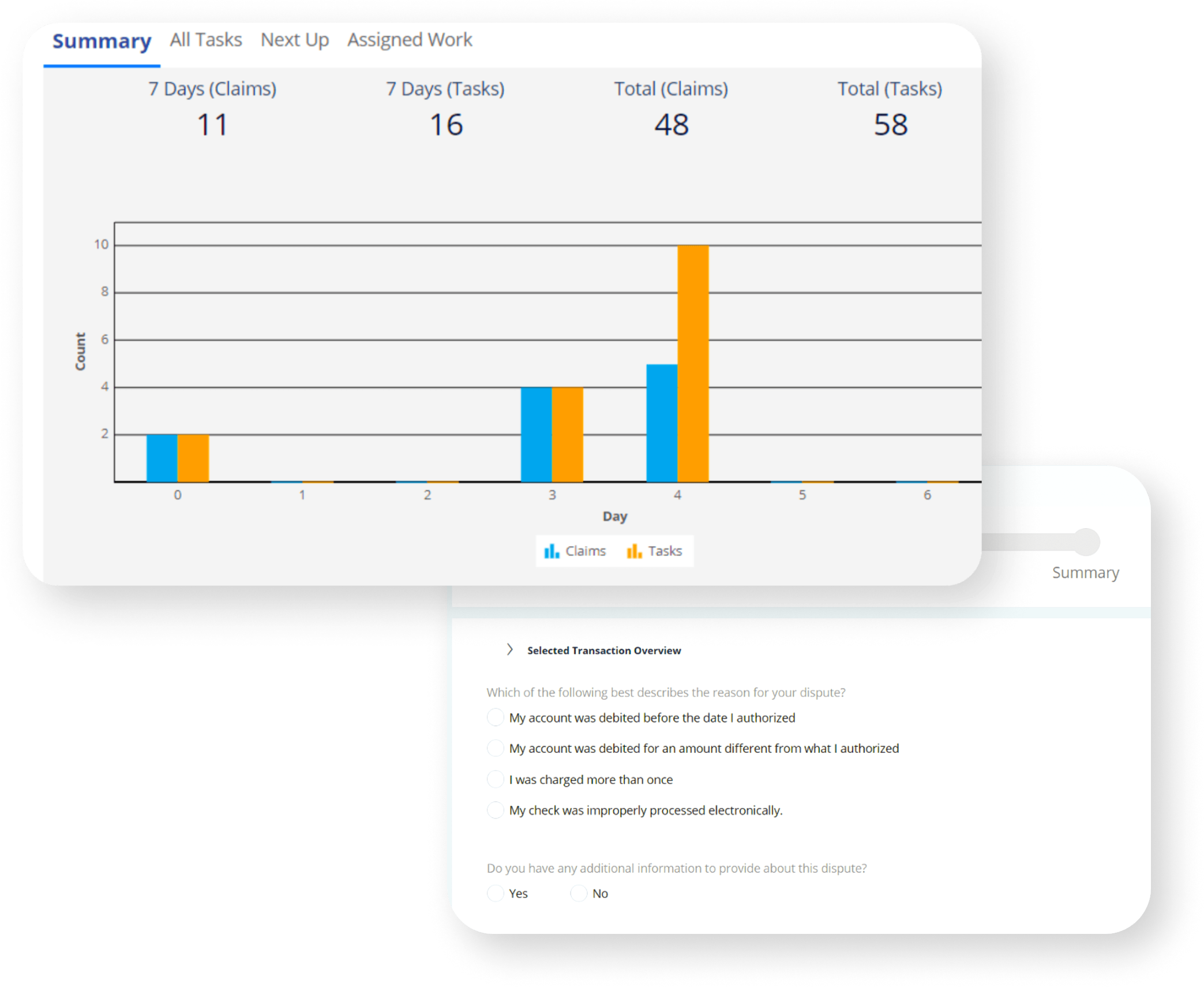

With over $1,677,243,400 recovered for 12,470,096 victims, Quavo leads with trust-driven solutions. Our agentic AI platform empowers financial institutions to accelerate resolutions, reduce friction, and build long-term loyalty, driven by actionable insights and transparency.

Quavo helps institutions build trust through transparent, real-time customer updates and faster dispute resolutions. Empower your cardholders to feel in control, increase loyalty, and reduce churn with our trust-driven solutions.

Quavo’s platform automates complex regulatory processes, ensuring transparency and accuracy that strengthens customer confidence while protecting your institution.

Quavo transforms your dispute operations into a model of efficiency. Our innovative platform minimizes loss risk at every stage of the dispute process. Streamline your processes and achieve a leaner, more profitable operation with Quavo.

Mitigate Risk, Elevate Customer Experience:

Proactively safeguard your institution with advanced fraud claim intake, seamless dispute management, and compliance agility.

Optimize Resources, Enhance Member Loyalty:

Streamline operations, maximize cost-efficiency, and provide exceptional support experiences for your valued members.

Scale with Confidence, Innovate with Ease:

Achieve rapid growth, ensure compliance in a dynamic regulatory landscape, and deliver frictionless customer interactions.

Improve Dispute Offering, Boost Client Satisfaction:

Provide top-tier service to issuing clients with robust integrations that enable lightning-fast, error-free claim management.

Reduce Regulatory Risk, Maintain Oversight at Scale:

Centralize dispute management and enforce compliance across all programs and customer touchpoints.

Explore how Quavo’s QFD® revolutionizes credit card dispute management for First Hawaiian Bank, transforming the process through cutting-edge automation.

Task Automation

Growth Year-Over-Year

Direct Clients Across 500+ Programs

Disputes Processed Annually

Quavo helps institutions build trust through transparent, real-time customer updates and faster dispute resolutions. Empower your cardholders to feel in control, increase loyalty, and reduce churn with our trust-driven solutions.

Quavo’s platform automates complex regulatory processes, ensuring transparency and accuracy that strengthens customer confidence while protecting your institution.

Quavo transforms your dispute operations into a model of efficiency. Our innovative platform minimizes loss risk at every stage of the dispute process. Streamline your processes and achieve a leaner, more profitable operation with Quavo.

By submitting your information, you agree to Quavo’s Terms of Service and Privacy Policy.