Executive Corner

A Message from David Chmielewski,

Quavo CPO & Co-Founder

Hello Clients and Partners,

As we close out 2025, I want to take a moment to reflect on an incredible year of innovation. Our product teams have been pushing hard to deliver solutions that meet the evolving needs of our clients.

Let’s start with AI. We’ve been investing in AI for nearly 10 years, but we really pushed the envelope in 2025. From auto-filtering email responses that don’t need human attention to conducting fraud investigations in seconds, our AI capabilities are setting the standard for what’s possible in dispute management.

Next up: Data. We heard your need for more analytics and insights. Our legacy reporting was a solid foundation, but this year we took it to the next level with nearly 50 engaging dashboards and Report Builder, which puts the power of custom reporting directly in your hands.

Finally, work management. We know workforce management is complex and every team operates differently. That’s why every release includes enhancements to help you manage work more effectively. Managers can structure teams based on knowledge, talent, and experience. With all-size work queues and drill-down settings, we’re supporting everyone from seasoned specialists to new hires.

None of this innovation happens in a vacuum. Your feedback drives our roadmap, and your partnership makes all of this possible. Thank you for collaborating with us, challenging us, and trusting us to deliver.

Sincerely,

David Chmielewski

CPO & Co-Founder

Features On the Horizon

By popular demand, we’ve added automated recovery workflows for the Pulse network. Soon you’ll have chargebacks, filings, and fraud reporting fully automated.

Powered by a 20+ point scorecard created with our DRE team, this AI tool speeds up fraud investigations by automating clear-cut cases and equipping your team to focus where it matters most.

Our new self-service intake and case-status channel eliminates the need for complex OLB provider integrations. Beta testing is underway, and we’ll be adding enhancements ahead of the broader release.

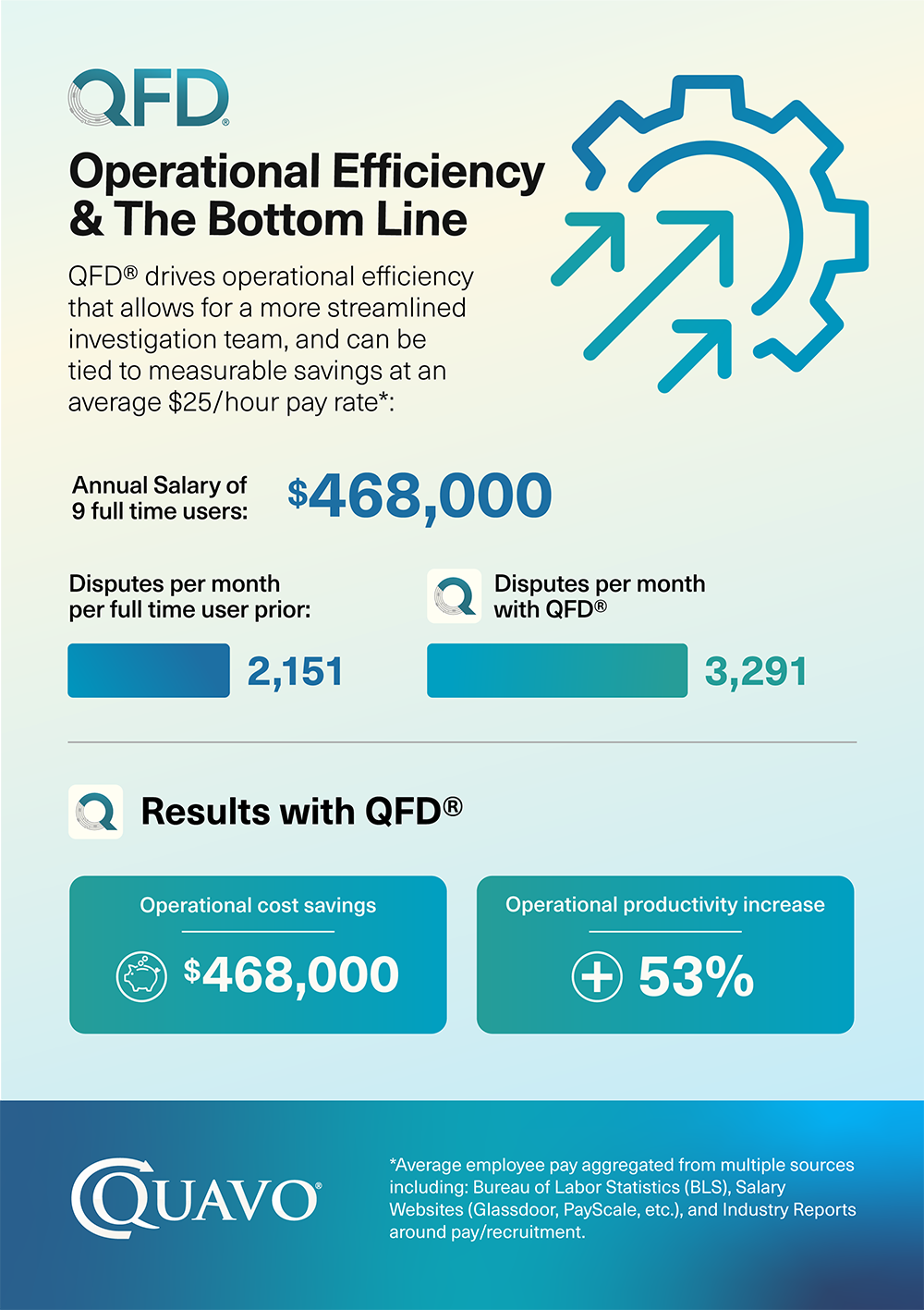

KPI Corner

Welcome to the Quavo Community!

Upcoming Events

Make sure to follow the Quavo LinkedIn or check our events page to stay up to date on our upcoming events!

Money 20/20

Las Vegas, NV | Oct 26-29th | Booth 6044

Be sure to attend our speaking session on Sunday, October 26th at 10:45 AM PST as CEO Joe McLean joins Nash Ali, Head of Strategy from Experian/Neuro ID as they discuss Turning Fraud Resolution into Brand Loyalty.

Dishing on Disputes – Session 5

What Happens When the Call Comes from Inside the House?

We’re closing out the year with our final webinar, featuring a conversation between two exceptional minds: Joe and Jarred will tackle the topic of first-party fraud. Whether a well-intentioned mistake or a deliberate act of theft, first-party fraud remains a critical challenge for the financial industry. Join us as we explore why it happens and share strategies leaders can use to minimize losses and strengthen dispute management practices.

Quavo in the News

Quavo Fraud & Disputes Secures $300 Million Growth Investment from Spectrum Equity

Quavo announced a $300 million investment from Spectrum Equity to accelerate AI-driven innovation and expand its market presence as the leading fraud and dispute management platform for financial institutions.

First City Credit Union and Quavo Partner to Deliver Secure Online Fraud Resolution for Displaced Members Following LA Fires

Quavo partnered with First City Credit Union to enhance fraud and dispute resolution services for members impacted by the LA fires. Leveraging AI-driven automation and digital self-service tools, the partnership ensures members can easily report issues, track progress, and receive fast, fair resolutions from anywhere.

Quavo Fraud & Disputes Releases Landmark 2025 State of Dispute Management Performance Report

Quavo has released its 2025 State of Dispute Management Performance Report, a first-of-its-kind benchmark study analyzing how financial institutions are navigating the growing complexities of fraud and dispute resolution. Drawing on performance data from 26 clients and industry benchmarks, the report highlights key trends in customer satisfaction, efficiency, and recovery—offering financial institutions a roadmap to turn dispute management into a strategic advantage.

New Report from Cornerstone Advisors and Quavo Underscores the Importance of Fraud Resolution in Consumer Banking Relationships

A new report from Cornerstone Advisors, commissioned by Quavo, finds one in four consumers give their bank a failing grade on fraud resolution, showing its impact on trust and card usage. Download the full report to see how improving fraud resolution can boost loyalty and growth.

Quavo Fraud & Disputes Selected to Debut Breakthrough AI Functionality at FinovateFall 2025

Quavo debuted new AI capabilities for its flagship dispute management platform, QFD®, at FinovateFall in New York City. The enhancements, powered by insights from over 20 million real-world cases, help clients detect friendly fraud earlier, reduce invalid disputes, and deliver faster, more accurate resolutions for accountholders.

Quavo Leads the Way in Fraud Operations with Consortium-Based Intelligence

Quavo announced a strategic partnership with Equifax to bring a consortium-based approach to detecting and stopping first-party fraud across the financial services industry. By combining Quavo’s dispute data with Equifax identity insights, FIs will gain real-time visibility into repeat offenders, reducing fraud losses, improving efficiency, and enabling faster, smarter action against suspicious activity—all directly within the QFD platform.

Quavo Thought Leadership

Here’s Your Due Diligence Checklist for AI Fraud Dispute Management

SME: David Chmielewski, CPO & Co-Founder

Fraud Is Inevitable. Cardholder Attrition Doesn’t Have to Be.

SME: Joseph McLean, CEO & Co-Founder

Modernizing Fraud Disputes with AI: Balancing Cost, Compliance and Customer Trust

SME: David Chmielewski, CPO & Co-Founder

Six Lessons + Six KPIs: What I’ve Learned in More Than Two Decades Helping Financial Institutions Resolve Customer Disputes

SME: Rex Richardson, Director of Client Processing

Modernizing Fraud Disputes with Four

Proven Strategies: Where Trust and Loyalty are Won

SME: Ryan Sorrels, CRO

Implementing AI technology in Credit Unions: Balancing Innovation with People-Centered Values

SME: Aafie Somers, Product Marketing Manager

Five Questions Bank Leaders Must Ask to Improve Fraud Dispute Resolutions

SME: Ryan Sorrels, CRO

Staying Ahead of Card Network Mandates Webinar

Featuring: Dave Chmielewski, CPO and Daniel Perret,

Director of Product Delivery

Blogs

By: Sindy Jordan

Account Manager

From Hands-On Hustle to Intelligent Automation: How QFD Is Transforming Dispute Management

By: Andy Weedman

Senior Product Manager