Executive Corner

A Message from David Chmielewski,

Quavo CPO & Co-Founder

Hello Clients and Partners,

The Quavo team has been hard at work enhancing QFD and exploring new ways to streamline dispute processing. And what would a 2025 newsletter be without a nod to AI? It can write recipes, generate memes, and even rap battle itself—but can it help with disputes? Absolutely.

We’re focused on automating the “last mile” of tasks using AI, starting with user augmentation. Whether it’s an accountholder email that just says “Thanks” or a representment filled with blurry screenshots and legalese—Advanced Automation AI, we need you!

On the industry front, networks are emphasizing accurate fraud reporting. Visa has long allowed updates to fraud reports after denial, but Mastercard requires a new API to do so. We’re committed to accuracy too, so this capability is built into the 25.01 QFD release. Mastercard clients, this feature needs some configuration—please connect with your account manager to enable it.

Looking ahead, we’re investing deeply in data. We love dispute metrics! Check out the new reports and dashboards in 25.01, and contact your account manager to learn more. Between AI, expanded network integration, and data-driven insights, we’re excited to keep pushing the envelope—thanks to your continued partnership.

Warm Regards,

David Chmielewski

CPO & Co-Founder

25.01 Release Notes

Coming April 29 – QFD version 25.01 is packed with 63 enhancements, new reports, and powerful add-ons to elevate your dispute operations. We’re taking a look at five standout enhancements and how they improve dispute management, compliance, and efficiency.

Precision in Workload Distribution

Managers can now assign tasks to specific team members based on expertise, ensuring cases are handled by the right people. Users can also filter and prioritize their work, allowing them to focus on high-priority tasks, such as those with tight compliance deadlines. This reduces training friction and streamlines case handling.

Smarter Fraud Reporting (Optional)

This API-driven feature automates fraud reporting to Mastercard while allowing issuers to remove transactions from the fraud database when necessary. By preventing overreporting penalties and supporting manual review for flagged errors, this enhancement improves fraud prevention accuracy, reduces costs, and enhances data integrity.

Automating Merchant Response Review (Add-On)

QFD’s AI Representments feature analyzes and summarizes complex, image-rich merchant response documents. Instead of investigators manually sorting through pages of data, AI extracts key insights, compares them against case details, and provides a clear, concise summary—helping teams resolve disputes faster and with greater accuracy.

Ensuring Compliance

A new configuration ensures that credit card non-fraud claims are automatically denied if the transaction occurred more than 60 days from the statement date. This automation strengthens Regulation Z compliance and removes manual intervention from routine denials.

7 New Reports for Deeper Insights

QFD’s Business Intelligence suite now includes several additional reports, covering critical areas like chargebacks, dispute reopen requests, and arbitration tracking. With expanded dashboards, financial institutions gain a clearer view of dispute operations, helping them measure performance, optimize workflows, and make data-driven decisions faster than ever.

Mandates

Demonstrating our commitment to compliance and operational excellence, we have successfully implemented the Spring 2025 Visa and Mastercard Mandates, released on April 12. These updates enhance regulatory alignment, incorporate industry best practices, and strengthen fraud prevention measures.

The Visa mandate updates include changes to currency codes, refinements to fraud dispute categories, and improvements in chargeback handling procedures.

Key updates:

Updated verbiage to the cryptocurrency/NFT question on the Fraud questionnaire. The question now reads: “Did you participate in the transaction, but were deceived into sending funds or merchandise to a fraudulent recipient?”

Users will be prompted to upload a document confirming the merchandise is counterfeit under 13.4 Counterfeit Merchandise Questionnaire.

Chargeback rights have been updated for 10.4 Other Fraud where a transaction has a Card Verification Value 2 (CVV2) of N, recovery rights are not available.

When submitting a chargeback for 12.6 Duplicate Processing/Paid by Other Means, the question “Is the other transaction paid by other means?” is required.

The 15-calendar day chargeback delay is no longer required when the merchant is bankrupt/insolvent for 13.1 Merchandise Not Received.

The Mastercard mandate enhancements address key areas related to chargebacks, merchant dependencies, and fraud prevention.

Updates include:

The Fraud questionnaire has been updated with revised wording for the cryptocurrency/NFT question. It now asks: “Did you participate in the transaction but were deceived into sending funds or merchandise to a fraudulent recipient?”

Two questions have been updated on Not as Described/Defective Details to read, “Please provide a detailed description of what was ordered/purchased and how it did not match the description. Please include all relevant details.”

Pre-Arbitration timeframes have been adjusted so that a pre-arbitration case must be filed within 30-calendar days from the second presentment, and an arbitration case must be filed within 15-calendar days from the acquirer rejecting financial responsibility for the pre-arbitration presentment.

Chargeback reason code 4853 Transaction Did Not Complete is no longer eligible for card-present transactions (non-key entry). Users can proceed with the Refund not Processed or Cardholder Debited More than Once recovery reasons.

Tips & Best Practices

Updating the Dispute Reason in Recovery

There are situations where the dispute reason needs to be updated based on merchant documentation. This important action can take place during the Representment and Dispute Response processes.

When accepting partial liability or declining liability, the user is prompted to answer the question, “Are you changing the dispute reason?” By selecting “Yes,” a follow-up question will populate, prompting the user to select the new dispute reason. Keep in mind that the category must remain either fraud or dispute.

Unlocking Insights with Our Favorite Reports

Data is the key to measuring success and optimizing operations, which is why our robust reporting suite comes standard. Now, with our Business Intelligence offering, you can dive even deeper into your dispute and fraud data.

Here are some of our favorite reports that help teams drive efficiency and compliance:

Claims List – A comprehensive view of all claims, regardless of status. With seven filters and 30+ data columns, you can drill down to track volumes, trends, and key attributes with precision.

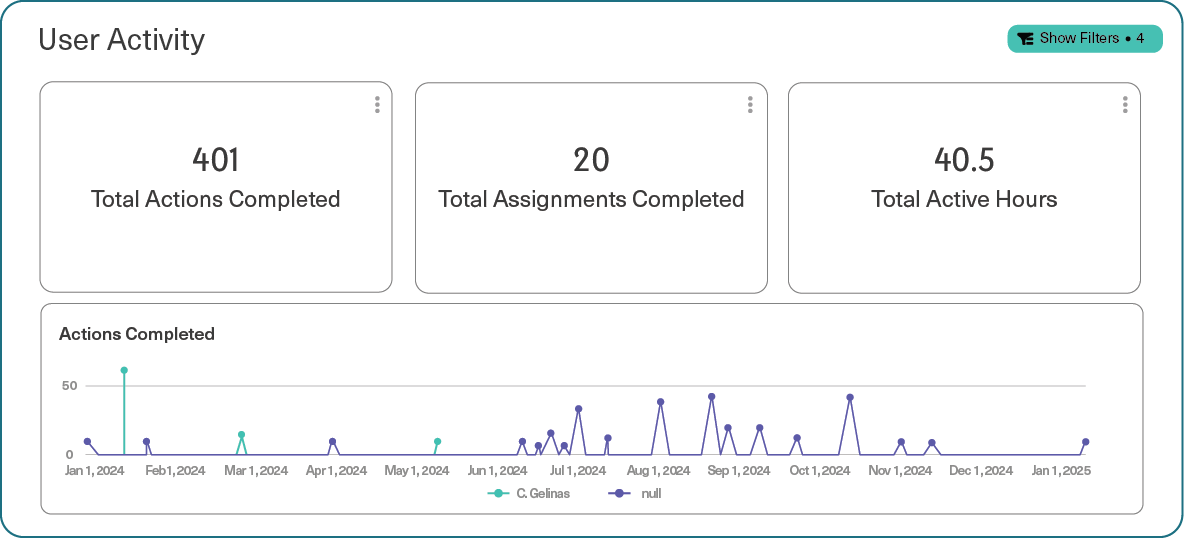

User Activity Report – A client favorite! This report provides a detailed overview of actions and assignments by user. Use it to measure productivity, workflow efficiency, and the time required for key tasks. We recommend clients use completed assignments for measuring performance and completed actions for analyzing workflows and user activity.

Reg E Details – Your go-to report for Regulation E compliance. Access all critical dispute data—including claim reasons, network details, deadlines, and action dates—ensuring you stay audit-ready.

Quavo AI Has Launched

Are you ready?

Our industry-leading dispute management technology just got even smarter. By combining Machine Learning, Generative AI, Vision AI (powered by Optical Character Recognition), and business rules, we’re driving data insights, investigator efficiency, and enhancing automation capabilities—building on QFD’s already robust functionality.

AI Inbound Correspondence

Fully automates email processing for auto-replies and withdrawal requests. One client saw 36% of inbound email volume redirected from investigators, freeing them up for high-value accountholder interactions.

AI Representments

Enhances merchant response processing with AI-powered document analysis. It summarizes lengthy, image-rich representment documents and cross-checks them with case data—streamlining this often tedious process.

See AI in action by checking out our demo. When you’re ready to infuse AI into your QFD stack, reach out to your Account Manager.

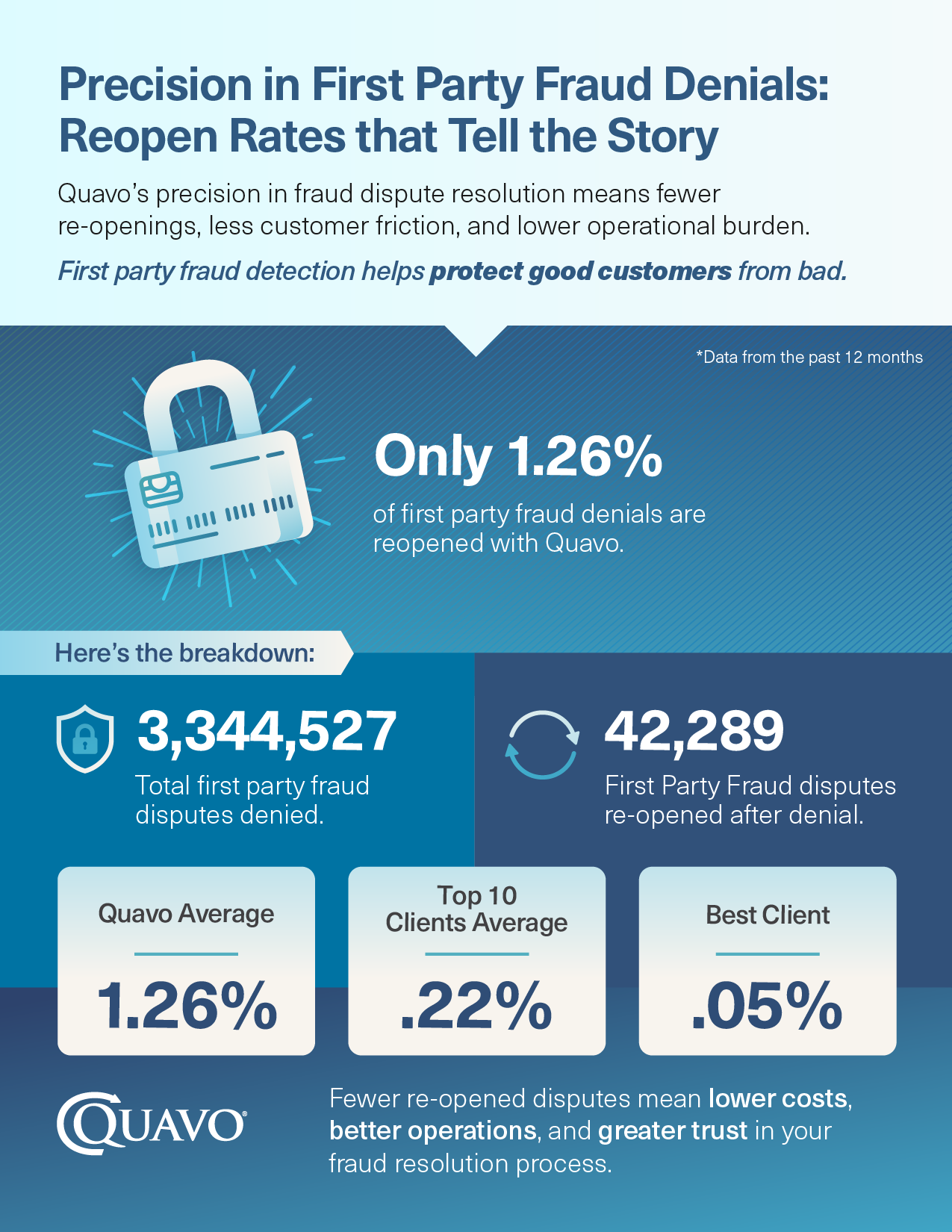

KPI Corner

Quavo in the News

Whitepaper | The Trust Factor: Turning Fraud Challenges into Customer Loyalty Opportunities

In Quavo’s Trust in Banking Consumer Study, we asked credit card fraud victims about their perceptions of how their banks responded to fraud. What mattered most to them was not the fraud incident itself, but how their banks responded. Read the latest report.

By: Joseph McLean

Quavo CEO & Co-Founder

Making Trust a Key Business Metric in Banking

New research reveals that trust is a critical KPI for customer retention in banking, with fraud resolution speed and transparency playing a key role in loyalty and growth. Banks that prioritize swift, clear dispute handling can turn fraud incidents into trust-building opportunities.

By: Joseph McLean

Quavo CEO & Co-Founder

Why Fraud Resolution is Critical to Building Customer Trust

As fraud rises, banks must prioritize trust-building strategies in dispute management. Implementing best practices for quick and effective resolutions is essential for maintaining strong, long-term customer relationships.

By: David Chmielewski

Quavo CPO & Co-Founder

AI Can Make Fraud & Dispute Resolution Faster — And Build Trust

Customer trust is impacted more by how banks handle fraud disputes than by the fraud itself. In fact, seven out of 10 consumers say a poor resolution experience would make them question all their banks’ other services. AI has the promise to improve speed, transparency and accuracy throughout the dispute process.

Lunch and Learn | Dishing on Disputes

In case you missed it, we launched our inaugural “Dishing on Disputes”! In this episode, David Bliss and Ike Sullenberger reveal how tracking the right metrics can reduce losses, optimize recaptures, and increase efficiency—all based on insights from 40+ financial issuers.

Blogs

Welcome to the Quavo Community!