The fraud and dispute landscape has experienced unprecedented transformation, driven by high transaction volumes, sophisticated fraud schemes, and heightened customer expectations. As issuers navigate this complex environment, they find themselves at a crossroads between traditional methods and emerging technological solutions.

Traditional processes rely on manual investigations, requiring significant human resources to review cases, collect evidence, and correspond with customers. However, this approach shows its limitations. Manual processes are not only labor-intensive and error-prone but also struggle to keep pace with growing transaction volumes, leading to frustrated customers and delayed resolutions. Compounding these challenges, many institutions continue to operate on inadequate legacy systems that fail to meet modern payment processing demands.

Modern Solutions

In response to these challenges, the market has developed various solutions to help issuers modernize their operations.

Dispute Management Platforms

Provide integrated solutions that combine case management, automated processes, and compliance features.

Straight-through processing (STP)

Automation software capable of STP has emerged as a game-changer in streamlining dispute workflows. By automating tasks such as chargeback submissions and evidence-based decisions, issuers can reduce operational costs and improve accuracy.

Staffing Vendors

Offer access to expertise and scalable resources, though this approach may raise concerns about vendor dependency and data security.

Innovation Disruptions

Financial institutions fail to advance their stack by following outdated paradigms.

Antiquated Management

Traditional case management, where investigators handle cases end-to-end, is inefficient for high volumes, wasting skilled resources on routine tasks. Rigid divisions between fraud and non-fraud teams further limit flexibility, causing bottlenecks, uneven workloads, and missed opportunities for cross-functional learning.

Rising Labor Costs

Issuers face workforce challenges from fluctuating dispute volumes driven by seasonal peaks, product launches, campaigns, mergers, and more. Overtime strains staff, causing burnout and errors, while hiring adds costs and delays. Many turn to Business Process Outsourcing (BPO), but this often reduces control and adds high processing fees.

Compliance Expertise

The regulatory landscape for fraud and disputes is complex, governed by federal regulations and frequently updated card association rules. Biannual updates demand constant adaptation, requiring costly compliance experts to interpret changes, update systems, and ensure adherence. These stringent requirements drive up operational costs and impact efficiency but remain non-negotiable.

More than Automation

Straight-through processing (STP) represents a system’s capability to autonomously process and resolve disputes without human intervention.

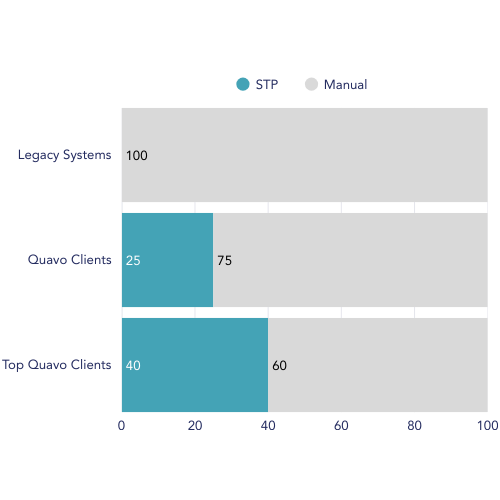

STP goes beyond process automation, transforming how financial institutions handle disputes. On average, Quavo clients achieve 25% STP of their total dispute volume while top clients see over 40% dispute STP.

STP is powered by configurations, ensuring decisions are aligned with your objectives.

- Decision Thresholds: Many solutions offer the ability to apply instant decisions if the disputed amount is under a specified threshold.

- Recovery Automation: Based on the solution and the issuer’s infrastructure, connection to card associations allow for automated chargebacks and case updates.

- First-Party Fraud Check: Safeguard your organization with pre-built claim abuse checks that flag suspicious accounts.

- Transaction Type: Determine if the solution you need supports a wide range of transaction types including both card and ACH.

- Manager Reviews: Manager reviews ensure accurate processing of high dollar disputes, resulting in more manual work but better aligning with business goals.

- Merchant Collaboration: Maximize your Ethoca and/or Verifi use with an integrated solution that streamlines the collaboration process.

Benefits of Straight-Through Processing

The ideal dispute management solution drives operational efficiency, reduces fraud and dispute-related costs, and, most importantly, enhances customer satisfaction. STP represents one of the latest advancements in dispute technology, empowering issuers to achieve these benefits and beyond.

Ensured Compliance

Stay ahead of regulatory requirements with automated administrative tasks, including customer correspondence and accounting adjustments. Meet tight deadlines with ease, avoid excessive losses, and ensure your operations remain fully compliant.

Optimized Workforce

Enable your team to focus on what matters most. Straight-through processing handles high volumes of disputes, freeing your staff to tackle complex cases requiring human expertise. With this newfound capacity, you can reskill, uptrain, promote, or redeploy your workforce to align with strategic goals.

Elevated CX

Deliver nearly instant, fair, and accurate decisions that build trust and confidence with your accountholders. Faster claim resolution not only improves satisfaction but also strengthens customer loyalty to your organization.

Reduced Losses

Cut operational costs by minimizing manual labor in dispute resolutions. Straight-through processing adapts to your firm’s best practices, ensuring consistent decisions while maintaining cost efficiency, even as dispute volumes fluctuate.

Case Study: Top Regional Bank

A major regional bank experienced growing pains as they innovated their product offerings, dominating both traditional banking and digital financial services.

Problem

The bank faced compliance challenges in their dispute management operations, consistently struggling to meet regulatory requirements and industry standards.

A comprehensive solution that could address multiple opportunities was needed. First, this system needed the ability to manage disputes across a diverse range of transaction types, each requiring its own dedicated and compliant workflow. Second, robust investigation support capabilities to handle the overwhelming volume of disputes; and third, built-in compliance controls to ensure adherence to regulatory requirements.

The bank’s growth and digital transformation hinged on finding a solution that could scale effectively while maintaining regulatory compliance and operational efficiency.

Solution

Moving into their third year with Quavo, the bank has achieved best-in-class efficiency in investigation productivity and boasts a 43% dispute STP.

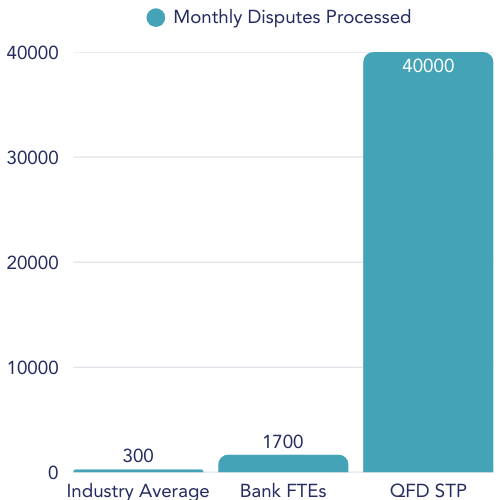

Each full-time employee (FTE) works an average 1,700 disputes per month, beating out the industry average five times over.

Intaking over a million disputes annually, 43% STP means that over 40,000 disputes are processed with no human touch every month.

Wrap-Up

With STP capabilities, Quavo’s premier dispute management solution, QFD works the same dispute volume as 23 FTEs. This boost to efficiency allowed the bank to rethink their workforce as they continued to grow their financial services and products.